Standard Life Investments Select Property Fund has sold its Polish logistics portfolio to Logicor, Blackstone’s European logistics platform and a leading operator of modern facilities in Europe for €118.2m. The proceeds from the sale will be reinvested in growth orientated assets in other markets where the economic recovery is increasing occupier demand and rents.

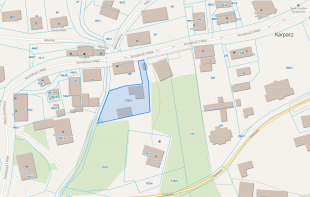

The portfolio, which was developed by Standard Life Investments and development partner, PDC, in 2007/08, consists of seven prime logistics assets providing over 200,000 sq m GLA of warehouse and office space and a development plot of 70,000 sq m located within three parks in strategic locations – Mysłowice (Upper Silesia), Stryków (Central Poland) and Robakowo (Poznań).

During the financial crisis, the logistics portfolio provided high-yield, defensive characteristics that fulfilled the demand of international occupiers. However, backed by the Standard Life Investments’ house view, the Select Property Fund is now looking to invest in growth orientated assets focusing on the office and retail sectors in key cities in Europe and specifically Tokyo, as these markets are expected to experience improving growth over the next few years.

Andrew Jackson, Fund Manager, Standard Life Investments Select Property Fund, said: “This sale reflects the Fund’s forward momentum. We’re exiting a period of relative caution and this disposal will help us meet our current objective to refocus on assets that will benefit from the economic recovery we are now seeing in a number of markets internationally. As a Fund we remain a committed investor in Poland and continue to look for new opportunities in line with our overall Fund strategy.”

Mo Barzegar, Chief Executive of Logicor, said: “We are delighted to acquire these assets which will be integrated into Logicor, Blackstone's European logistics platform. Logicor continues to grow strongly and this acquisition will enable us to expand and deepen our customer relationships across the region.”

Soren Rodian Olsen, Head of Office & Industrial Investments at Capital Markets of Cushman & Wakefield in Poland, commented, “This disposal represents one of the largest logistics portfolio transactions in Poland which demonstrates a continued strong demand for high quality logistics assets in strategic Polish distribution hubs.”

Cushman & Wakefield represented Standard Life Investments.

(fot. materiał prasowy)