Interview with Paweł Sapek, Senior Vice President & Country Manager in Prologis Poland.

Given the growth of the e-commerce market, is Prologis planning to invest in smaller SBU storage facilities or in urban logistics centres?

Only this year, e-commerce customers rented 80.000 square meters of Polish Prologis parking lots, mainly in Szczecin, Poznań, and Warsaw. We continuously monitor the sector's demand for modern warehouse space and try to respond to market signals where the demand is greatest. After the success of the SBU warehouse lease in Prologis Park Wrocław III, we will soon start the construction of another facility of this type, this time in Chorzów. Companies from the e-commerce sector are also among the clients. It is worth noting that Prologis provides modern spaces for clients from different industries that can be tailored to specific business needs of a company. Build-to-suit buildings are, of course, the exception – they are designed in accordance with the expectations of a particular company from the very beginning.

According to the estimates of PMR, the vast majority of 9.6 million square metres of modern warehouse space available in Poland meets the strict criteria of the e-commerce industry, such as: location close to customers and employees, entresols, dual power source, a larger number of docks, the possibility to tailor the space to the needs of customers. In addition, over the next six moths almost 50 large warehouse units for rent will be on the market, which will give the possibility to choose a convenient space to companies engaged in online trading. Such well-developed warehouse resources show that the Polish market is well prepared for the dynamic growth of the e-commerce industry, which does not force developers to intensify activities aimed at new investments in the online commerce sector. However, we do not rule out the possibility of building new objects, for example SBUs, where the presence of such type of warehouse is justified.

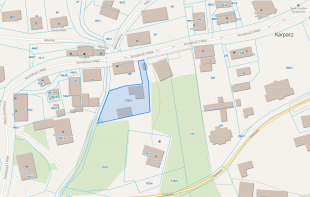

Do you have a land bank that will allow for this type of investments?

Yes. Thanks to our own land bank we are able to execute large projects in the largest Polish cities over a period of several months.

How do you evaluate the demand for space in 2015 and can 2016 be even better?

The e-commerce sector in Poland is growing at a double-digit pace. According to PMR, in 2014 the share of e-commerce in retail sales reached 3.9%, but in 2020 it could rise to 10%. As a consequence, the demand for warehouse space will increase. New lease agreements concluded by e-commerce companies could even reach 700.000 square metres by 2020. The availability of human resources, attractive labour costs and relatively low lease costs give Poland a chance to attract new players from the e-commerce industry and from other industries. The demand should increase from automotive companies, FMCG companies, or logistic service providers. Then there is organic development of companies already present in the market.

Do you agree with the statement that the conflict behind the eastern border spurred the demand for warehouse space in Poland?

The conflict between Ukraine and Russia shows no significant impact on the Polish warehouse market. This conflict certainly affects the transaction volume of companies operating in the Eastern European market. We expect that many contracts have been cancelled or temporarily suspended, which did not, however, result in more investments of the Eastern companies in Poland.

Are there enough workers to handle warehouse spaces?

Finding qualified workers is and will remain one of the key criteria when locating e-commerce companies. Poland, as a country offering competitive rates of pay, is the goal o many companies from the e-commerce sector. According to the report of Prologis titled "European e-commerce sector, e-fulfilment, and new work places", the development of electronic order management can give rise to more than 200.000 new work places over the next five years, or 100 work places per day. Many of them will surely emerge in Poland, where there is no shortage of qualified workers, and the rate of unemployment is quite high.

The current average in the e-commerce sector is 10-15 workers per 1000 square meters of distribution space, but this number can double during the peak season. The above employment levels are 2 to 5 times higher than those that occur in a traditional distribution center. The development of the e-commerce sector results also in an increase of new work places in the case of subcontractors, but also in external companies supporting e-commerce entities in IT and delivery areas.

What sectors, in addition to e-commerce, will promote the development of the warehouse market in the coming years?

In addition to e-commerce, retail chains play a leading role in the commercialisation of warehouses. Also automotive companies are becoming more and more active, for example: General Motors, Volkswagen, Mercedes. They often choose places where they can create clusters with their subcontractors, suppliers, or customers, which enables them to reduce supply times to a minimum. The emergence of new players in the market causes increased interest on the part of contractors – suppliers of components and services, production companies, logistics and distribution companies that, in order to shorten delivery times and reduce costs, decide to move parts of their businesses to locations in the immediate vicinity of warehouses. It is estimated that each work place created by a car manufacturer generates about 3 work places at suppliers, which automatically translates into investments in new production facilities or the expansion of new facilities.

Paweł Sapek, Senior Vice President & Country Manager in Prologis Poland